Clark Wealth Partners for Dummies

Getting The Clark Wealth Partners To Work

Table of ContentsThe 6-Minute Rule for Clark Wealth PartnersThe 9-Minute Rule for Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners The Basic Principles Of Clark Wealth Partners The Clark Wealth Partners IdeasGet This Report on Clark Wealth Partners5 Easy Facts About Clark Wealth Partners Described

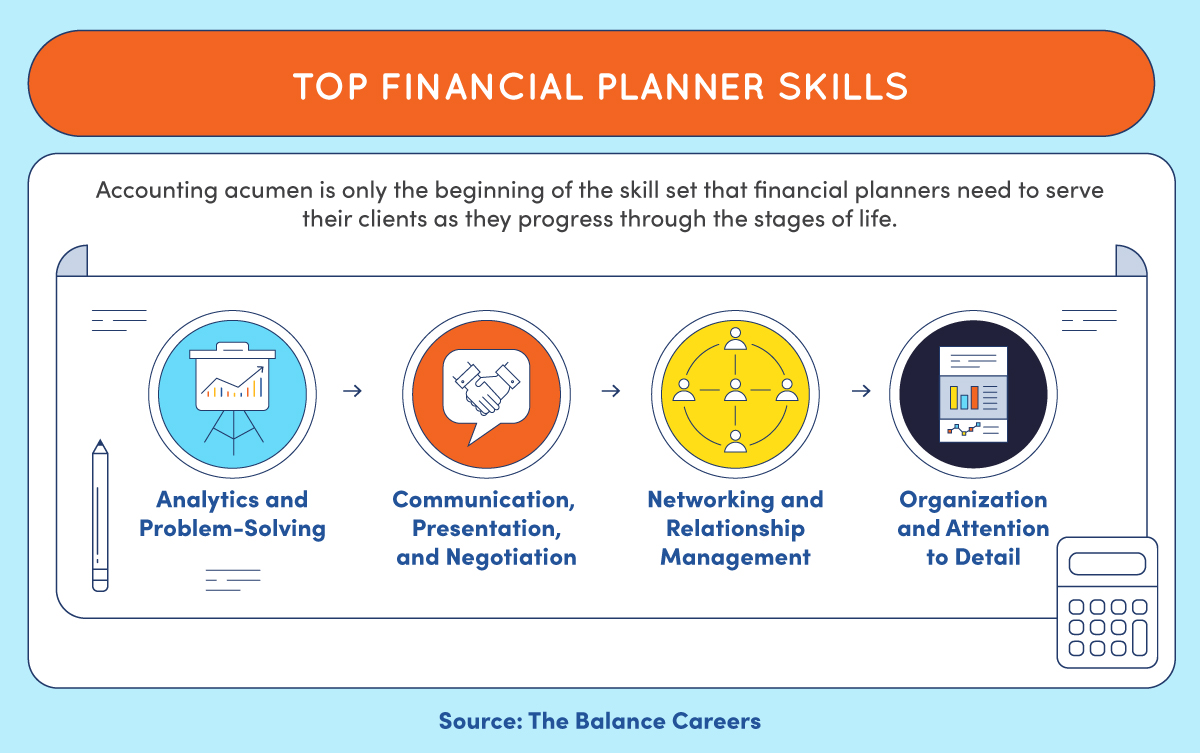

The world of money is a difficult one., for example, just recently discovered that almost two-thirds of Americans were incapable to pass a fundamental, five-question financial proficiency test that quizzed participants on topics such as passion, financial obligation, and various other fairly basic principles.In addition to managing their existing customers, economic experts will certainly typically spend a reasonable amount of time each week meeting with potential clients and marketing their services to keep and grow their service. For those considering becoming an economic consultant, it is vital to think about the average salary and job security for those operating in the area.

Training courses in tax obligations, estate preparation, financial investments, and risk monitoring can be helpful for students on this course. Relying on your one-of-a-kind profession objectives, you might also require to make details licenses to fulfill certain customers' requirements, such as dealing supplies, bonds, and insurance coverage. It can likewise be useful to earn a qualification such as a Qualified Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS).

Little Known Facts About Clark Wealth Partners.

What that looks like can be a number of things, and can differ depending on your age and stage of life. Some people fret that they require a particular amount of money to spend before they can get help from an expert (st louis wealth management firms).

Some Of Clark Wealth Partners

If you haven't had any experience with a monetary consultant, here's what to expect: They'll begin by offering an extensive assessment of where you stand with your properties, obligations and whether you're satisfying standards contrasted to your peers for financial savings and retirement. They'll evaluate brief- and long-term objectives. What's useful concerning this step is that it is customized for you.

You're young and functioning full time, have a cars and truck or more and there are trainee loans to settle. Right here are some possible concepts to help: Develop great financial savings practices, repay financial debt, established standard goals. Pay off student lendings. Depending upon your profession, you may certify to have component of your college lending forgoed.

Unknown Facts About Clark Wealth Partners

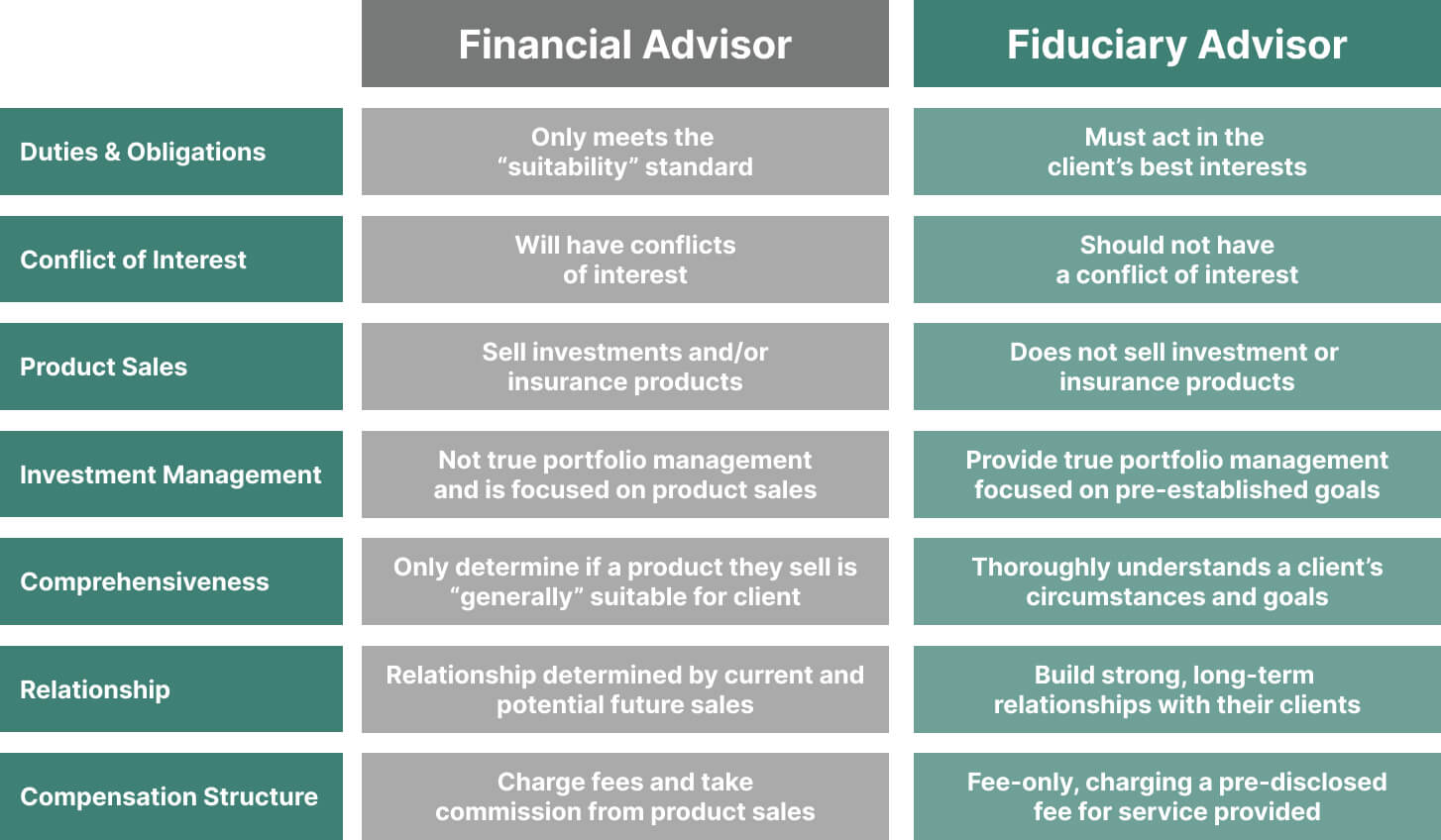

Then you can go over the next finest time for follow-up. Prior to you start, ask regarding pricing. Financial advisors typically have various tiers of rates. Some have minimum possession levels and will bill a charge normally a number of thousand dollars for developing and adjusting a plan, or they might bill a level fee.

Constantly check out the fine print, and make certain your economic advisor adheres to fiduciary requirements. You're expecting your retired life and helping your youngsters with college costs. A financial expert can supply guidance for those circumstances and more. Many retirement supply a set-it, forget-it choice that assigns possessions based on your life phase.

The Ultimate Guide To Clark Wealth Partners

That might not be the most effective way to maintain building wealth, especially as you advance in your occupation. Arrange regular check-ins with your organizer to fine-tune your strategy as required. Stabilizing cost savings for retired life and college costs for your kids can be challenging. An economic advisor can help you prioritize.

Thinking of when you can retire and what post-retirement years may look like can generate issues concerning whether your retired life cost savings remain in line with your post-work plans, or if you have actually saved sufficient to leave a legacy. Help your monetary professional understand your strategy to money. If you are much more traditional with saving (and prospective loss), their recommendations must react to your fears and issues.

Excitement About Clark Wealth Partners

Planning for wellness treatment is one of the large unknowns in retired life, and a financial professional can outline choices and suggest whether additional insurance policy as defense might be helpful. Before you start, useful link try to get comfortable with the concept of sharing your entire monetary picture with a specialist.

Offering your expert a complete photo can assist them create a plan that's focused on to all parts of your economic standing, specifically as you're quick approaching your post-work years. If your finances are easy and you have a love for doing it yourself, you might be great by yourself.

An economic expert is not just for the super-rich; anybody dealing with significant life shifts, nearing retired life, or sensation bewildered by financial choices can take advantage of specialist support. This post explores the function of monetary advisors, when you might need to consult one, and crucial considerations for picking - https://form.typeform.com/to/xJ51jype. A financial advisor is an experienced professional that assists customers manage their financial resources and make informed decisions that line up with their life objectives

Some Known Facts About Clark Wealth Partners.

Compensation designs also vary. Fee-only experts bill a flat fee, hourly rate, or a portion of properties under monitoring, which tends to reduce potential problems of passion. On the other hand, commission-based advisors gain earnings with the monetary items they market, which might influence their referrals. Whether it is marriage, separation, the birth of a child, career adjustments, or the loss of an enjoyed one, these events have distinct financial implications, commonly needing prompt choices that can have enduring impacts.